Can You Sue After a Lyft Accident?

Although ridesharing services are very popular and convenient for everyday use, ridesharing services are not without risk. It is important to understand that lyft drivers are not specially trained drivers. When you use ridesharing apps, you are putting your fate in the hands of a stranger. In Florida, lyft drivers operate as independent contractors who become commercial drivers as soon as they pick up a passenger and begin a ride. Unfortunately, after a lyft accident, many injured victims come to realize that lyft will often try to avoid paying personal injury claims to passengers. However, if you take the time to properly educate yourself on lyft’s insurance policy coverages and take the proper steps after a lyft car accident, you can build a strong personal injury claim and obtain the compensation you deserve.

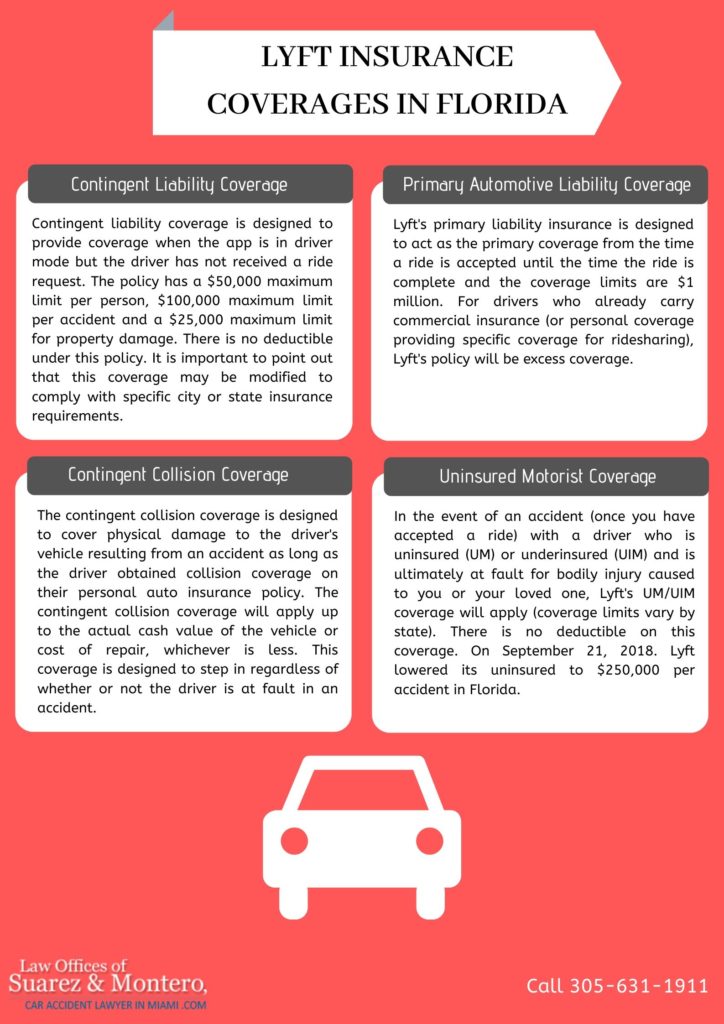

Lyft requires their drivers to carry their own insurance coverage, but they usually supplement these policies with their own $1 million insurance policies. To begin, it is important to understand lyft’s insurance coverages and how and when it may apply during the progression of your lyft ride. There are 4 types of insurance coverages that may apply from the time you accept a ride until the time that the ride is complete: Contingent liability Coverage, Primary Automotive Liability Coverage, Collision Coverage, and Uninsured/Underinsured Motorist Coverage. Contingent liability coverage is designed to provide coverage when the app is in driver mode but the driver has not received a ride request. The policy has a $50,000 maximum limit per person, $100,000 maximum limit per accident, and a $25,000 maximum limit for property damage. There is no deductible under this policy. It is important to point out that this coverage may be modified to comply with specific city or state insurance requirements.

Lyft’s primary liability insurance is designed to act as the primary coverage from the time a ride is accepted until the time the ride is complete and the coverage limits are $1 million. For drivers who already carry commercial insurance (or personal coverage providing specific coverage for ridesharing), Lyft’s policy will be excess coverage.

The contingent collision coverage is designed to cover physical damage to the driver’s vehicle resulting from an accident as long as the driver obtained collision coverage on their personal auto insurance policy. The contingent collision coverage will apply up to the actual cash value of the vehicle or cost of repair, whichever is less. This coverage is designed to step in regardless of whether or not the driver is at fault in an accident. In the event of an accident (once you have accepted a ride) with a driver who is uninsured (UM) or underinsured (UIM) and is ultimately at fault for bodily injury caused to you or your loved one, Lyft’s UM/UIM coverage will apply (coverage limits vary by state). There is no deductible on this coverage. On September 21, 2018, Lyft lowered its uninsured to $250,000 per accident in Florida. Below is an infographic that breaks all of that information down:

You may be wondering, but when do these coverages apply? During the time the Lyft Driver app is on and available to accept a request (also known as “driver mode”), the contingent liability policy is in effect. The other three coverages are in effect when a driver accepts a ride request and end when the ride is complete. In the event that your driver is renting a car through lyft’s express drive program, one of Lyft’s renter’s insurance partners coverage will apply. Express Drive insurance coverage depends on whether the driver is on driver mode, waiting for a ride request, or has a ride in progress when the accident occurs. It is best practice to make a bodily injury liability claim against both Lyft’s insurance provider (Click here to see Lyft’s Certificate of Insurance) and the Lyft driver’s personal policy at the same time. Tip: This can help speed up settlement of your claim and can avoid common tactics like lyft’s insurer claiming that your claim needs to be worth the limits of the Lyft drivers claim before they pay out on your claim.

Often, insurance payouts offer limited damages that might not fully cover your medical needs and damages. As a lyft accident victim, you could face serious medical expenses and may be out of work after an accident. Most automobile insurance policies pay for medical expenses and lost wages, but they may limit these damages, and they will not pay for pain and suffering. Instead, filing your case in court could fully cover these needs.

However, Florida’s car insurance law only allows car accident victims to file a personal injury claim in court when your injuries are severe enough to cost more than $10,00 or when your injuries are considered “permanent” in nature, which can include permanent effects on bodily functions or significant scarring/disfigurement. Otherwise, your case may not be allowed to go to court. Another important consideration is that although Lyft keeps a cut of the money drivers earn on rides, the drivers are not “employees” of Lyft. That means that Florida’s vicarious liability rules would not allow you to extend a lawsuit to include Lyft as a responsible party in your lawsuit. However, this does not mean you can’t get compensation for an accident involving an Uber or Lyft. Personal injury law in Florida allows you to formally seek compensation for your injuries by filing a lawsuit against whoever caused the accident that led to your injuries. Car accidents that were caused by Lyft drivers are no exception.

To prevail on your claim, you will need to prove that the Lyft driver owed you a duty of care to keep you safe or out of harm’s way, the Lyft driver failed to uphold this duty, that failure was the cause of your injuries, and the extent of your injuries. These elements are similar in all other car accident lawsuits, as well as in all other personal injury cases.

If your lawyer can establish that a Lyft driver’s negligence was responsible for causing your injury, you may receive compensation through Florida’s personal injury protection (PIP). However, there is a limit as to how much you can recover through this type of insurance coverage. In Florida, PIP benefits pay for 80% of your initial medical treatment, but the maximum amount of these payments is limited to $10,000. Unfortunately, if you are not diagnosed with an emergency medical condition, PIP benefits are limited to only $2,500. In Florida, your health insurance coverage should pay medical expenses that PIP and Medpay do not pay. In Florida, health insurance is secondary to PIP and Medpay. This means that PIP needs to be billed first. After PIP is billed, your health insurance may pay for any remaining balances and/or you will get contractual discounts. Please be aware that if your health insurance pays your medical expenses, it will likely have a right to be reimbursed from the settlement.

If you or a loved one is involved in a lyft accident, it is in your best interest to not handle the claim on your own. Seek the help of an experienced personal injury attorney in Florida who handles claims with rideshare companies as they can help guide you through the claims process. Each coverage can greatly differ depending on how the claim is filed and when the claim is filed. Contact the Miami lyft accident lawyers at Suarez & Montero to find out how we can help. We’re prepared to help you fight for the money you need and deserve. Call to schedule a free consultation today. We are available 24/7 to take your call.